This content has been archived. It may no longer be relevant

Magna Financial Market Report –January 15th 2025

|

|

|

|

|

|

• GBP gains on weak CPI

• USD slides on gradual tariff news

|

|

|

RECAP

During yesterday’s European session, the USD remained weak, partly due to a dip in PPI numbers released in the afternoon. This added to the earlier sell-off, which was triggered by a report indicating that members of Donald Trump’s economic team are now considering a gradual increase in tariffs, contrary to previous administration statements.

Meanwhile, GBP continued to face selling pressure throughout the day as markets adopted a cautious stance ahead of today’s CPI release. However, there was some relief in the UK gilts market, which showed signs of stabilization following last week’s sell-off.

|

|

|

|

|

|

|

|

|

|

OUR SUMMARY

GBP is seeing a rise this morning, offering a sense of relief for traders after CPI numbers came in lower than expected. This has increased the likelihood of two rate cuts by the Bank of England this year. While lower inflation figures would typically weigh on GBP, in the current context, they are helping to ease concerns about the UK economy. The recent spike in gilt yields due to an increased risk premium is starting to subside, giving GBP some support.

However, broader concerns remain. The upcoming GDP numbers for November are closely watched, with risks to the UK’s outlook still present. A report from the British Retail Consortium indicates that two-thirds of UK retailers plan to raise prices due to higher taxes, while over half intend to cut staff hours, and 46% foresee reducing headcount. As such, any GBP relief could be short-lived.

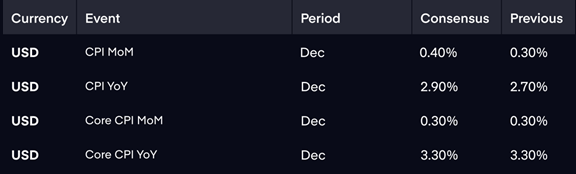

Looking ahead, much attention will be on today’s CPI report from the US. Given yesterday’s lower PPI numbers and reports suggesting a gradual approach to tariffs, markets could react strongly to a soft CPI print, possibly leading to profit-taking on the USD’s recent gains. This could extend the recent rebound in GBP/USD and EUR/USD. Conversely, a higher-than-expected CPI figure could see the USD strengthen once more.

|

|

|

|

HOW WE CAN HELP

Our team of currency experts are here to help you get more from your money when making international payments. We will work with you to understand your payment needs and offer specialised guidance on the best options available to you. Get in touch with Osman Hanif today on +44 (0) 20 3371 9200 or email osman@magnafinancial.com.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|