Magna Financial Market Report – January 31st 2025

|

|

|

|

|

|

• Focus on possible tariffs on Canada and Mexico

• ECB reduced interest rates by 25 basis points

|

|

|

RECAP

Yesterday, the US dollar faced significant losses as traders reduced their long positions, driven by perceptions of the European Central Bank’s (ECB) meeting being less dovish than expected. The ECB, in line with market forecasts, implemented a 25 basis point rate cut, and the unanimous decision among policymakers reinforced the view that inflation will return to target levels. The ECB maintained its meeting-by-meeting approach, with no changes to forward guidance.

Meanwhile, the Japanese yen saw the strongest gains of the day, buoyed by remarks from Deputy Governor Ryozo Himino. He indicated that the Bank of Japan is prepared to continue raising interest rates if its inflation and economic outlooks come to fruition.

In the US, fourth-quarter GDP growth fell short of expectations, registering 2.3% instead of the anticipated 2.6%. Core PCE inflation for the period also rose to 2.5%, up from 2.2%.

|

|

|

|

|

|

|

|

|

|

OUR SUMMARY

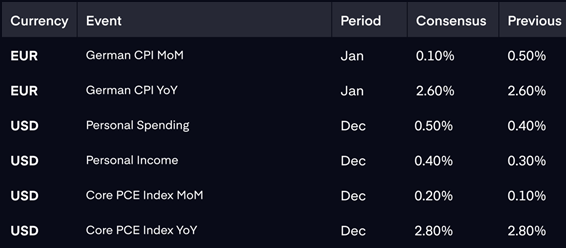

This morning’s French inflation data for January came in lower than anticipated, with Germany’s numbers expected later today. If inflation proves to be more persistent, it could lead markets to adjust their expectations, reducing the number of rate cuts anticipated by the ECB this year, which would be positive for

the euro. In the US, December’s core PCE inflation is unlikely to show much deviation from the expected figures, given that the fourth-quarter data from yesterday met forecasts.

In terms of USD volatility, attention will turn to potential tariffs on Canada and Mexico, with the Trump administration reiterating plans to impose a 25% tariff on these nations. This has already caused a dip in the CAD and MXN. While the tariffs are set to be implemented by February 1, 2025, markets will be closely monitoring any new developments or updates ahead of next Monday’s open.

|

|

|

|

HOW WE CAN HELP

Our team of currency experts are here to help you get more from your money when making international payments. We will work with you to understand your payment needs and offer specialised guidance on the best options available to you. Get in touch with Osman Hanif today on +44 (0) 20 3371 9200 or email osman@magnafinancial.com.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|