Magna Financial Market Report –December 11th 2024

|

|

|

|

|

|

• GBP stays supported by higher yields

• US CPI and BoC may increase USD demand

|

|

|

RECAP

GBPEUR rose to its highest level since April 2022, driven by growing expectations that the Bank of England will cut interest rates more slowly than the European Central Bank throughout 2025. This movement came just before Thursday’s ECB meeting, where the market expects only a 25bps rate cut.

GBPAUD also moved higher following the dovish stance taken by the Reserve Bank of Australia earlier in the day.

The USD extended its gains for the third consecutive day, supported by higher treasury yields and in anticipation of today’s CPI data.

|

|

|

|

|

|

|

|

|

|

OUR SUMMARY

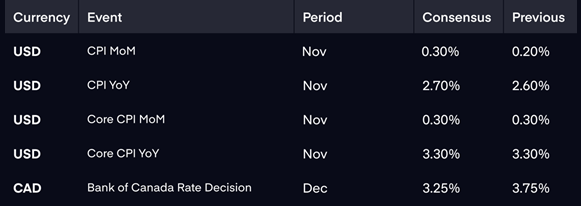

Today’s main focus is the release of the US CPI data, which could provide key insights into inflation trends. The market will be watching closely for any upside surprises that may signal rising inflationary pressures. This CPI release is the last one before next week’s Federal Reserve meeting, where an 85% chance of a 25bps rate cut is currently priced in. An unexpectedly strong CPI report could shift these odds lower, supporting the USD.

Additionally, the USD could find further support if the Bank of Canada opts for a smaller 25bps rate cut, contrary to the market’s current 50bps expectation. Such a move could lead to a higher probability of the Fed maintaining its current policy stance next week.

GBPEUR is maintaining the gains made yesterday, and with tomorrow’s ECB meeting approaching, there is potential for it to test the highs seen in March 2022.

|

|

|

|

HOW WE CAN HELP

Our team of currency experts are here to help you get more from your money when making international payments. We will work with you to understand your payment needs and offer specialised guidance on the best options available to you. Get in touch with Osman Hanif today on +44 (0) 20 3371 9200 or email osman@magnafinancial.com.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|