Magna Financial Market Report –December 18th 2024

|

|

|

|

|

|

• UK inflation rises as forecasted

• Fed expected to lower rates by 25bps

|

|

|

RECAP

After stronger wage data in the morning, the GBP held onto its gains, pushing gilt yields higher. This shift in market sentiment led to a reduction in the expected number of rate cuts by the Bank of England (BoE) for next year, with current pricing indicating just two 25 basis point cuts in 2025.

|

|

|

|

|

|

|

|

|

|

OUR SUMMARY

This morning’s CPI data showed inflation rising as expected, having little effect on the GBP, which remains slightly lower after yesterday’s gains. The upcoming Bank of England (BoE) meeting tomorrow will be the next key event for the currency.

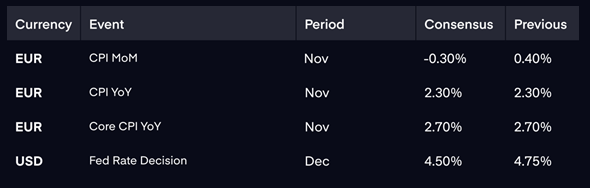

In the Eurozone, final CPI figures are set to be released, but little market movement is anticipated. The main focus later will shift to the Federal Reserve meeting.

We anticipate a 25 basis point rate cut from the Fed, along with an adjustment to their previous rate cut projections for next year. This revision is likely influenced by the potential fiscal stimulus under President-elect Trump.

Overall, unless there are unexpected dovish signals from the Fed, we expect the USD to stay well supported.

|

|

|

|

HOW WE CAN HELP

Our team of currency experts are here to help you get more from your money when making international payments. We will work with you to understand your payment needs and offer specialised guidance on the best options available to you. Get in touch with Osman Hanif today on +44 (0) 20 3371 9200 or email osman@magnafinancial.com.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|