Magna Financial Market Report –December 20th 2024

|

|

|

|

|

|

• Dovish BoE drags down GBP

• USD strengthened ahead of core PCE data

|

|

|

RECAP

Yesterday, the GBP faced a decline after three members of the Bank of England (BoE) voiced support for a rate cut during the bank’s meeting, expressing concerns about the economic outlook and the labor market.

Although the BoE decided to keep rates unchanged this time, the dovish stance led to a sell-off in GBP and a drop in gilt yields. Additionally, several investment banks are now suggesting that markets may be underestimating the extent of rate cuts the BoE is likely to implement next year (currently priced at 55bps), with expectations leaning towards a 100bps reduction starting in February.

Meanwhile, upward revisions to US GDP bolstered USD strength following Wednesday’s Federal Reserve meeting, keeping the USD index near two-year highs.

|

|

|

|

|

|

|

|

|

|

OUR SUMMARY

GBP losses are continuing this morning, following weaker-than-expected retail sales, highlighting growth risks for the UK economy. This suggests that the impressive performance of GBP this year may not be repeated in 2025.

President-elect Trump reminded Europe of the need to address their significant deficit with the US by making substantial purchases of US oil and gas, or else face tariffs.

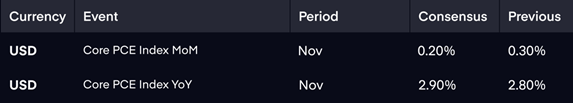

Looking ahead, the focus will be on the US core PCE inflation numbers due this afternoon. Any upside surprises could reinforce the hawkish stance taken by the Fed on Wednesday and boost USD gains.

This will also be the final market report for 2024. Thank you for your continued readership and support throughout the year.

|

|

|

|

HOW WE CAN HELP

Our team of currency experts are here to help you get more from your money when making international payments. We will work with you to understand your payment needs and offer specialised guidance on the best options available to you. Get in touch with Osman Hanif today on +44 (0) 20 3371 9200 or email osman@magnafinancial.com.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|