Magna Financial Market Report –December 4th 2024

Magna Financial Market Report –December 4th 2024

|

|

|

|

|

|

|

• USD rises on geopolitical tension

• GBP drops; EUR uncertain

|

|

RECAP

Markets experienced a period of relative calm yesterday after Monday’s fluctuations. The latest JOLT data revealed some minor signs of strength in the U.S. job market, but this had little effect on the USD.

Geopolitical developments also influenced foreign exchange markets. In South Korea, the declaration of martial law led to an initial increase in JPY strength. However, the rapid reversal of this decision caused the yen to lose ground, leaving President Yoon facing potential impeachment risks.

In Europe, French lawmakers are preparing for a no-confidence vote today, with expectations that Marine Le Pen will collaborate with a left-wing coalition to challenge the current government.

|

|

|

|

|

|

|

|

|

|

OUR SUMMARY

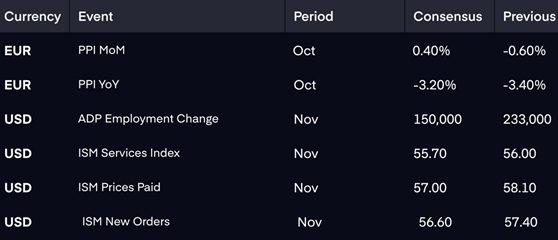

Geopolitical tensions in France and South Korea are likely to boost the appeal of the USD as a safe-haven asset. Today, market focus will be on the release of the ADP payrolls and ISM services data, which could influence the USD by providing insights into economic performance. Additionally, Fed Chair Powell’s evening

speech and the release of the Fed’s Beige Book may further impact

sentiment surrounding the U.S. dollar.

The British pound (GBP) opened the day lower following comments from Governor Bailey, who indicated the possibility of four rate cuts next year. Concerns about political developments in France are also creating uncertainty around the EUR and could have further implications for the currency.

|

|

|

|

HOW WE CAN HELP

Our team of currency experts are here to help you get more from your money when making international payments. We will work with you to understand your payment needs and offer specialised guidance on the best options available to you. Get in touch with Osman Hanif today on +44 (0) 20 3371 9200 or email osman@magnafinancial.com.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Magna Financial Market Report –December 4th 2024

Magna Financial Market Report –December 4th 2024