Magna Financial Market Report – Friday 14th February 2025

|

|

|

|

|

|

• GBPUSD and EURUSD strive for 2025 highs

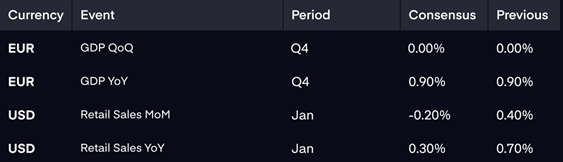

• EU GDP and US retail sales data ahead

|

|

|

RECAP

Yesterday afternoon, the USD experienced continued selling pressure following a CNBC report indicating that Donald Trump’s tariff announcement would not take effect immediately. Instead, the tariffs were expected to start around April 1st. This news led to both EURUSD and GBPUSD testing resistance levels.

However, neither pair was able to break through, suggesting that the markets were holding off on making significant moves until the announcement was made.

|

|

|

|

|

|

|

|

|

|

OUR SUMMARY

In the evening, the Trump administration signed a proposal for reciprocal tariffs on a country-by-country basis, set to begin in April. This move shook the markets, causing the USD to weaken. As a result, GBPUSD surged to its highest point this year, while EURUSD revisited key resistance levels.

Looking ahead, preliminary GDP figures for Europe’s fourth quarter will be released, followed by US retail sales data later in the day.

|

|

|

|

HOW WE CAN HELP

Our team of currency experts are here to help you get more from your money when making international payments. We will work with you to understand your payment needs and offer specialised guidance on the best options available to you. Get in touch with Osman Hanif today on +44 (0) 20 3371 9200 or email osman@magnafinancial.com

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|