Magna Financial Market Report –January 10th 2025

|

|

|

|

|

|

• GBP Sentiment Fading

• US Jobs Data in Focus, USD Likely to Stay Strong

|

|

|

RECAP

The GBP initially faced losses today, but these were somewhat moderated by the close, suggesting that markets may be coming to terms with the recent bond market instability, possibly viewing it as less severe than the turmoil witnessed during the Autumn Budget of 2022.

Although the Bank of England did not need to intervene this time, it is proactively expanding its toolkit to address potential bond market dysfunction. One of the measures being introduced allows eligible non-bank financial institutions to borrow cash using gilts (UK government bonds) as collateral. While immediate concerns have been eased, it appears that the positive sentiment around GBP seen last year is now beginning to reverse.

|

|

|

|

|

|

|

|

|

|

OUR SUMMARY

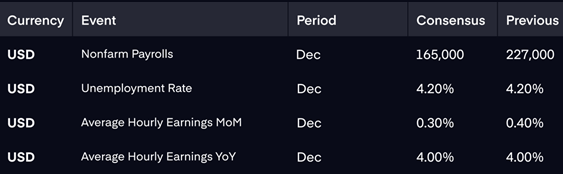

Following some hawkish comments from the Fed last night, all eyes are on the U.S. job report for December, with expectations set at 165,000 new jobs added and the unemployment rate holding steady at 4.2%.

Given the recent Fed rhetoric, there is a possibility that the job numbers could surpass expectations, which would likely boost the USD further. Even if the numbers disappoint and the USD weakens temporarily, we anticipate this will provide an opportunity for markets to buy USD at more favourable levels ahead of President-elect Trump’s inauguration.

Meanwhile, GBP has opened the day relatively flat, but sentiment remains negative. We foresee further weakness ahead, as GBP continues to retreat from its recent highs against a variety of currencies.

|

|

|

|

HOW WE CAN HELP

Our team of currency experts are here to help you get more from your money when making international payments. We will work with you to understand your payment needs and offer specialised guidance on the best options available to you. Get in touch with Osman Hanif today on +44 (0) 20 3371 9200 or email osman@magnafinancial.com.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|