Magna Financial Market Report – January 29th 2025

|

|

|

|

|

|

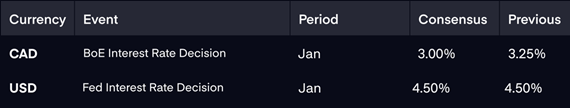

• USD is anticipated to stay strong with the Fed’s stance

• 25bp rate cut is expected from the BoC

|

|

|

RECAP

Yesterday, the USD remained steady, buoyed by Donald Trump’s statement advocating for universal tariffs significantly higher than the current 2.5%.

In Australia, the weaker-than-expected CPI data led to market expectations for a potential rate cut of 85 basis points this year, contributing to a decline in the AUD.

|

|

|

|

|

|

|

|

|

|

OUR SUMMARY

Tonight, all attention turns to the Federal Reserve, where the market anticipates the Fed will keep rates at 4.50% and adopt a cautious stance on future rate adjustments. Fed Chair Powell is expected to face questions about Donald Trump’s recent calls for rate cuts, but Powell is likely to reaffirm the Fed’s independence in setting rates. If Powell delivers a hawkish tone, the market may adjust its expectations, reducing the anticipated

cuts for this year to just 25bps instead of the current 50bps.

In the afternoon, the Bank of Canada will announce its interest rate decision, with a 25bp cut widely expected. The key focus will be on Governor Macklem’s forward guidance, particularly regarding any potential comments on US tariffs and their impact on Canada. A dovish outlook from Macklem could prompt the market to price in additional rate cuts by year-end, which would likely weaken the

CAD. Currently, markets are expecting 66bps worth

of rate cuts in Canada this year.

|

|

|

|

HOW WE CAN HELP

Our team of currency experts are here to help you get more from your money when making international payments. We will work with you to understand your payment needs and offer specialised guidance on the best options available to you. Get in touch with Osman Hanif today on +44 (0) 20 3371 9200 or email osman@magnafinancial.com.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|