Magna Financial Market Report – Monday 24th March 2025

|

|

|

|

|

|

• Tariff news lifts sentiment

• UK data week risks GBP

|

|

|

RECAP

Over the weekend, it was revealed that the Trump administration is shifting towards implementing more focused tariffs. Some countries may be excluded from these measures, and the scope of the tariffs is anticipated to be more limited than originally proposed.

|

|

|

|

|

|

|

|

|

|

OUR SUMMARY

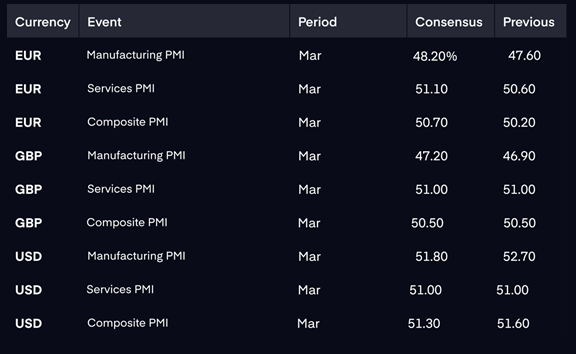

Markets are gearing up for “US Liberation Day” on April 2nd, with sentiment receiving a slight boost this morning due to the announcement of more targeted tariffs. The spotlight today is on PMI data from Europe, the UK, and the US. Should these figures indicate improvement compared to February, it may lead to a reassessment of the market’s expectations for rate cuts this year, particularly from the ECB, where there’s currently a 60% probability of a rate cut in April.

In the UK, this week is crucial, with CPI data and the Spring Budget on Wednesday, followed by retail sales on Friday. Headline CPI is expected to dip to 2.9% from 3%, while services CPI is projected to ease to 4.9% from 5%. As for the budget, markets are not expecting any major positive surprises, and the OBR is likely to revise productivity forecasts downward. This week could introduce risks for the GBP.

|

|

|

|

HOW WE CAN HELP

Our team of currency experts are here to help you get more from your money when making international payments. We will work with you to understand your payment needs and offer specialised guidance on the best options available to you. Get in touch with Osman Hanif today on +44 (0) 20 3371 9200 or email osman@magnafinancial.com

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|