Magna Financial Market Report – Wednesday 26th March 2025

|

|

|

|

|

|

• UK inflation drops, May rate cut likely

• US dollar falls, GBP and EUR rise

|

|

|

RECAP

As concerns over tariff impacts persisted, the US dollar took a hit, reflecting a significant decline in US consumer confidence, which reached its lowest level in four years. This contributed to a dip in the USD throughout the afternoon.

Currently, the US dollar index is down by 5% since the beginning of the year. Meanwhile, the GBPUSD has increased by 3.33%, and the EURUSD is up by 4.80% over the same period.

In other currency movements, GBPEUR continued to rise, reaching levels seen on March 5th. This upward trend coincides with market expectations being revised, with fewer rate cuts anticipated from the Bank of England this year.

|

|

|

|

|

|

|

|

|

|

OUR SUMMARY

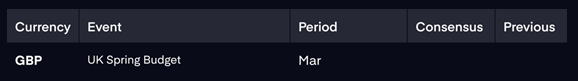

UK inflation came in at 2.8% for February, slightly below the expected 3%, which led markets to raise the likelihood of another rate cut in May to 80%. As a result, the pound has started the day weaker, especially ahead of this afternoon’s Spring Statement. However, we anticipate that the statement will have minimal impact on the FX market, as much of the information has already been priced in.

The Office for Budget Responsibility (OBR) is expected to revise down the growth forecast for the year. Despite this, the pound has seen a solid performance this quarter, rising 3.7% since January. Looking ahead to Q2, some analysts believe the pound could be overvalued, suggesting potential for a pullback.

|

|

|

|

HOW WE CAN HELP

Our team of currency experts are here to help you get more from your money when making international payments. We will work with you to understand your payment needs and offer specialised guidance on the best options available to you. Get in touch with Osman Hanif today on +44 (0) 20 3371 9200 or email osman@magnafinancial.com

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|