Magna Financial Market Report – Friday 28th March 2025

|

|

|

|

|

|

• US GDP Beats Expectations

• EUR Drops on Anticipated Rate Cuts

|

|

|

RECAP

Yesterday, despite US corporate profits soaring by 5.9%, the largest jump in over two years, the third GDP estimate came in at 2.4%, slightly better than the previous forecast of 2.3%. However, heading into the 4pm fix, the USD faced a notable sell-off. This shift was primarily driven by a Deutsche Bank report that raised concerns about the Federal Reserve’s commitment to ensuring dollar liquidity, particularly with key global allies. The report suggested that uncertainties around the reliability of USD swap lines could lead other nations to accelerate efforts to lessen their reliance on the US financial system. Interestingly, the sell-off was short-lived.

In contrast, the GBP experienced a more positive day, recovering from Wednesday’s decline. This was largely driven by market positioning rather than any fundamental change. Speculation is growing that, should the Chancellor propose a tax hike in the Autumn, markets may be underestimating the potential for rate cuts from the Bank of England this year.

|

|

|

|

|

|

|

|

|

|

OUR SUMMARY

UK retail sales data released this morning reveals a strong start to 2025, with sales increasing by 1% in February and 1.4% in January. This growth suggests that households are gradually dipping into their savings, as disposable incomes per person rose by 1.7% in Q4 of 2024. The positive data gave GBP a brief boost.

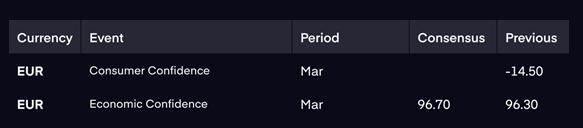

Meanwhile, the latest inflation data from France and Spain came in below expectations, leading markets to adjust their outlook for the European Central Bank (ECB). Initially, markets were anticipating a 50 basis point rate cut, but now the expectation has shifted to 60 basis points in further cuts this year. As a result, the EUR remains weaker heading into the end of the week.

Looking ahead, it’s expected to be a quiet day as markets await developments on April 2nd, particularly surrounding Trump’s ‘Liberation Day’. We predict trading will remain within the weekly ranges as investors await further clarity.

|

|

|

|

HOW WE CAN HELP

Our team of currency experts are here to help you get more from your money when making international payments. We will work with you to understand your payment needs and offer specialised guidance on the best options available to you. Get in touch with Osman Hanif today on +44 (0) 20 3371 9200 or email osman@magnafinancial.com

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|