Magna Financial Market Report – Friday 7th March 2025

|

|

|

|

|

|

• EUR boosted by ECB outlook

• Strong NFP needed to ease USD pressure

|

|

|

RECAP

Yesterday, the GBP experienced a significant drop following the release of the UK construction PMI data, which revealed a steeper-than-anticipated contraction in the sector. The figure fell to its lowest point since May 2020, raising concerns about the industry’s outlook.

Meanwhile, the European Central Bank (ECB) made the anticipated 0.25% rate cut, which further bolstered the EUR. The ECB’s statement that rates are “becoming meaningfully restrictive” added to the positive sentiment around the euro. As a result, market expectations now suggest that the ECB will only make two more rate cuts in 2025.

|

|

|

|

|

|

|

|

|

|

OUR SUMMARY

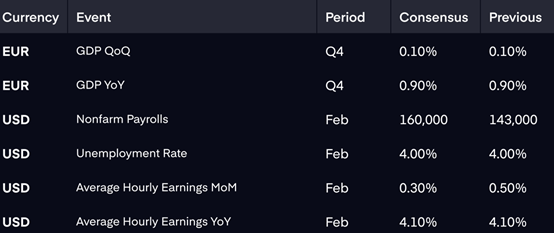

Today marks nonfarm payroll release day, with markets anticipating the addition of 160,000 jobs and an unchanged unemployment rate of 4%. As noted earlier this week, the USD’s recent depreciation will require a robust jobs report to reverse the trend. Both GBPUSD and EURUSD remain close to four-month highs.

A significant focus has been the EUR rally, which is on track for its strongest week against the USD since 2009. This is largely driven by perceptions of Germany’s fiscal stimulus efforts. Technical indicators, however, suggest that EURUSD may be overbought, indicating a possible retracement. In contrast, against the GBP, the same indicators do not signal an overextension, suggesting further potential gains for the EUR. The next support level for GBPEUR is at the low seen in January.

|

|

|

|

HOW WE CAN HELP

Our team of currency experts are here to help you get more from your money when making international payments. We will work with you to understand your payment needs and offer specialised guidance on the best options available to you. Get in touch with Osman Hanif today on +44 (0) 20 3371 9200 or email osman@magnafinancial.com

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|