Magna Financial Market Report – November 29th 2024

|

|

|

|

|

|

• Market expectations for a BoJ rate hike rise

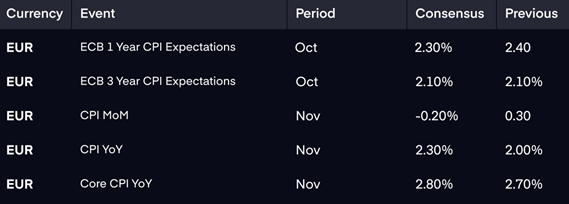

• EU CPI data will guide the ECB’s next decision

|

|

|

RECAP

In the afternoon, the euro dropped after ECB member Villeroy suggested that going below the neutral rate in the future could not be ruled out. He added that “optionality should remain open on the size of a cut” for December. Meanwhile,

Germany’s CPI data for November showed an upward trend from the

previous year, but it did not meet expectations.

|

|

|

|

|

|

|

|

|

|

OUR SUMMARY

The Japanese yen surged overnight as Japan’s inflation data came in stronger than expected, increasing speculation that the Bank of Japan might raise rates in December. This movement in JPY led to a USD sell-off, driving GBPUSD to two-week highs and EURUSD to one-week highs, though these gains have since softened. Today’s focus will be on Eurozone CPI figures, which could play a pivotal role in determining whether the ECB opts for a 25bps or 50bps rate cut on December 12. A robust CPI print would likely bolster the euro.

|

|

|

|

HOW WE CAN HELP

Our team of currency experts are here to help you get more from your money when making international payments. We will work with you to understand your payment needs and offer specialised guidance on the best options available to you. Get in touch with Osman Hanif today on +44 (0) 20 3371 9200 or email osman@magnafinancial.com.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|